Real Stories: Why George fell behind with his debts and how financial counselling helped

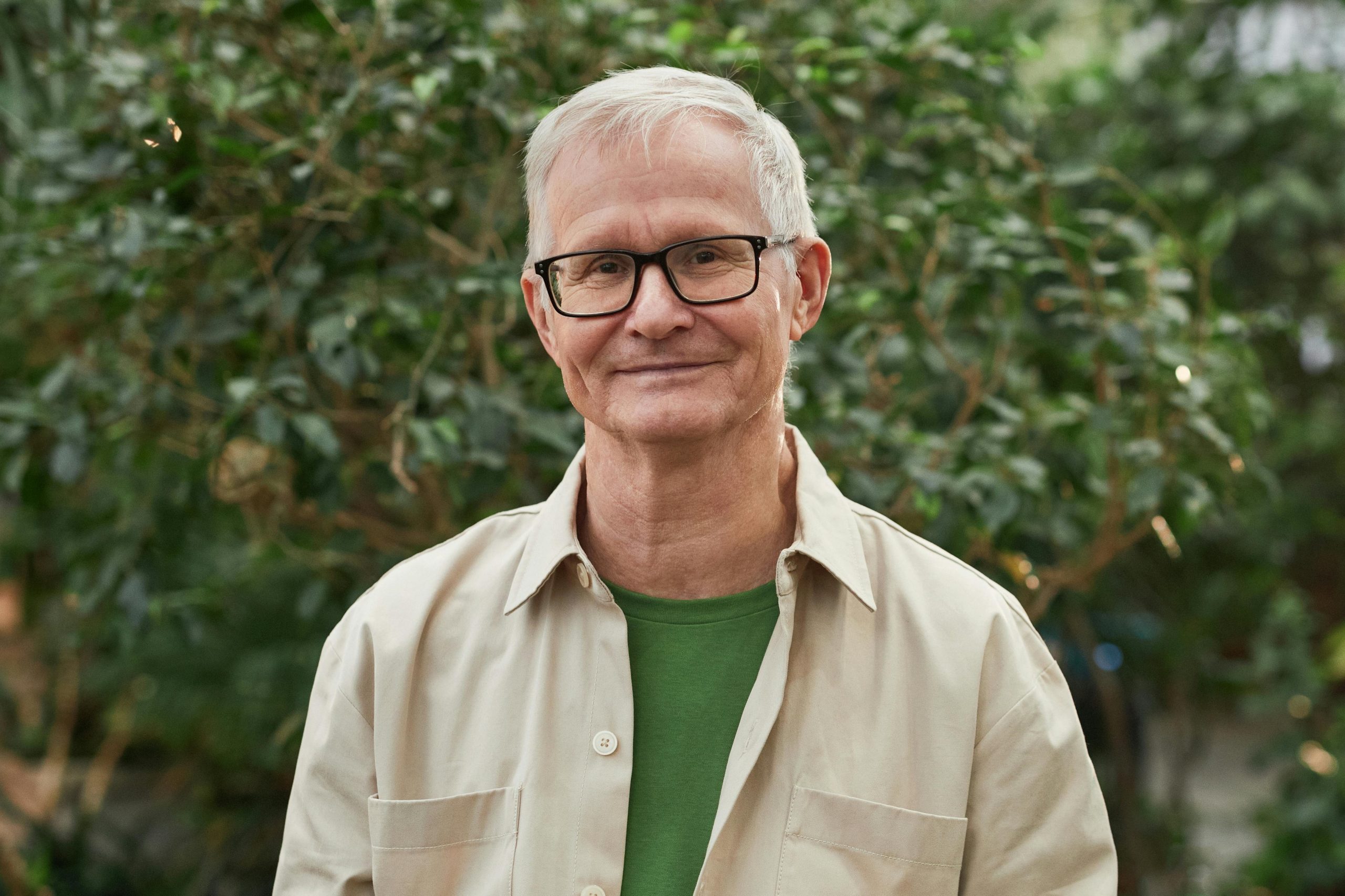

George's story:

Like the proverbial frog sitting in a pot of water slowly heating up, completely unaware of his doom, George (58), gradually fell further and further behind with his finances.

He had spent years struggling just to keep up paying for the basics of life and slowly fell behind to a point where everything he earned was spent as soon as it came in. He often went hungry and worried about having no emergency savings; no safety net for unexpected costs.

When his old fridge broke down and he had no funds to buy a new one, he consulted Anna, who was a Financial Capability Worker with a local service provider. George was amazed at the range of assistance Anna was able to provide him.

Firstly, Anna negotiated a debt reduction and freeze on an outstanding loan, and negotiated a more affordable repayment plan for George.

Next she found several concessions and rebates for energy and housing costs that he had not known about, and obtained a 20% discount rate for his electricity and gas bills with a new utility provider.

Finally, Anna helped George draw up a budget and spending plan, including paying a fixed monthly cost to cover all regular bills on an easyway payment scheme.

Instead of ending up with an expensive loan, George was referred to an affordable lending scheme who lent him money at zero interest for a new fridge.

“By the time we’d made all the changes, I was about $60 per week better off, and that has made a huge difference in helping me afford everything I need, plus, being able to save a little for a rainy day. I wish I’d done it sooner rather than spend years worrying about money”

Financial First Aid free financial counselling

Financial First Aid free financial counselling and mediation services are available to people who have money troubles and live in one of the many government funded areas across Victoria. First step is to enquire online or request an appointment.

For more real stories about people with financial troubles and how Financial First Aid financial counsellors mediated for them, go to the Financial First Aid website home page and scroll down to Real Stories.